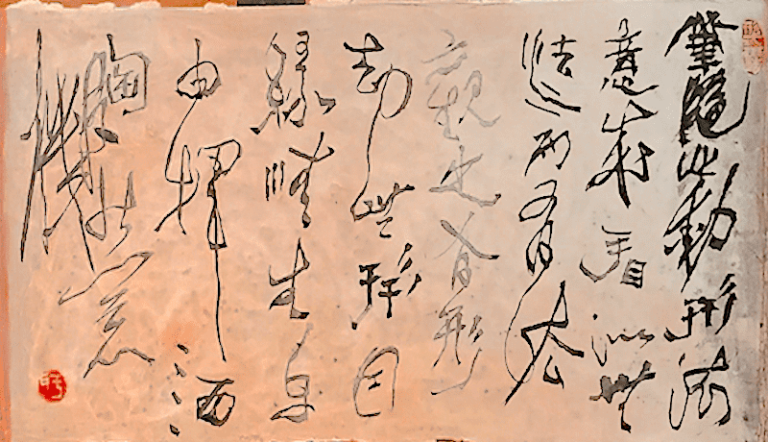

- Artist : Mr. Chau-yih Yu

In January 2018 Chunghwa Telecom – Taiwan’s leading telecoms company – announced that it will make a 5G pre-commercial system available in Taipei in 2020. The National Communications Commission (NCC) has welcomed the move. It has also stated that its legislative proposal on the Telecommunications Act – which is pending congressional review – will take a proactive approach in responding to the significant need for flexible frequency sharing and network use (for further details please see “NCC promotes regulatory reform of telecoms liberalisation”). Since the end of January 2018, the NCC has been issuing 9 million telephone numbers for mobile devices that mobile network operators are planning for applications of 4G Internet of Things (IoT), including:

- • public utilities;

- • smart metres;

- • medical monitoring; and

- • wearable devices.

The NCC has also confirmed that it intends for the 3.4 gigahertz (GHz) and 3.6GHz bands to be available for auction in 2020, aiming for large-scale 5G application.

In the final quarter of 2017, the top three mobile network operators – Chunghwa Telecom, FarEastone and Taiwan Mobile – initiated head-to-head competition in the roll-out of narrowband (NB) IoT services, which has since become a hot topic. NB IoT is a narrowband radio technology designed for the IoT and is one of a range of mobile IoT technologies standardised by the Third Generation Partnership Project. The NCC has estimated that the amount of 5G small stations to be installed in the next three years would be up to five times more than the existing number of 4G base stations. The NCC has further elaborated the core value of regulatory reform in respect of the Telecommunications Act, as mobile network operators will be allowed more room for co-ownership, sharing of frequency spectrum and network use in order to achieve economic efficiency.

However, mobile network operators have a different view. Operators have urged the NCC to consider a ‘beauty contest’ rather than an auction for the assignment of 5G spectrum, should cost efficiency be an issue in the policy consideration of 5G fast deployment. The higher rates of frequency use fees in addition to the price paid for each spectrum licence is also identified a major concern that should not be ignored. Currently, mobile network operators pay a frequency use fee of NT$10,675,000 (approximately US$368,100) for use of the 1 megahertz spectrum.

In line with its policy statement for telecom liberalisation, the NCC has stated that it will offer flexibility of spectrum right assignment and develop a secondary market for spectrum trading under the new Telecommunications Act. Further dialogue is expected when Congress opens its legislative session in February 2018.

The materials contained on this website are for general information purposes only and are subject to the disclaimer.